The latest IDC report has release the smartphone market share of Transsion, Samsung and Huawei in Africa during 2019.

The African mobile phone market grew 3.8 percent in Q4 2019, according to IDC — fulled by end-of-year sales promotions. Demand for entry-level phones launched throughout 2019 also supported shipment growth.

Feature phone business fell 2.6 percent to 34.4 million units. Feature phones business has 58.4 percent share in Africa. The Transsion brands Tecno and Itel also dominated the feature phone landscape with a combined share of 69.5 percent. HMD placed third with 10.2 percent share.

Smartphone shipments to Africa rose 5.4 percent in Q4 2019 to 24.4 million. Smartphone demand was driven by the launch of new affordable and feature-rich models.

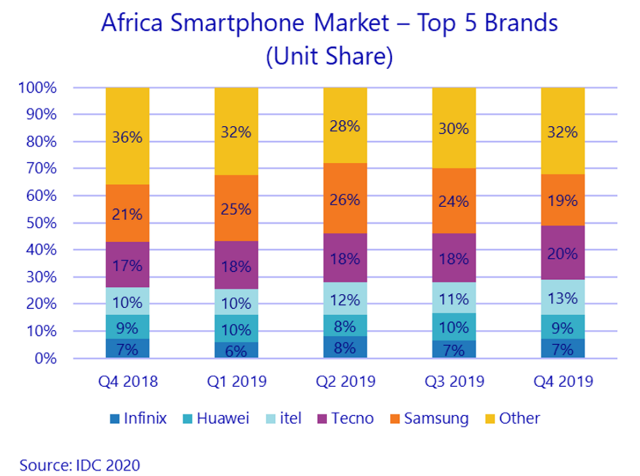

Transsion brands such as Tecno, Itel, and Infinix dominated Africa’s smartphone space in Q4 2019, with 40.6 percent unit share.

Samsung is the second leading smartphone brand in Africa with 18.6 percent share. Huawei is in the third place in Africa market with 9.8 percent share.

Transsion’s success can be attributed to the fact that its devices are competitively priced and largely purpose built for African consumers, says Arnold Ponela, research analyst at IDC.

South Africa’s smartphone market grew 2.2 percent in Q4 2019 to 6.5 million units. Leading smartphone brands such as Samsung, Huawei, and Mobicel are offering feature-rich entry-level smartphone models.

Nigeria’s smartphone market rose 5.3 percent to 2.9 million units. Tecno, Infinix, Itel, and Samsung dominate the Nigerian market, launching various models and promotions with network operators to attract customers.

Egyptian smartphone market grew 6.4 percent as phone vendors offered devices with more competitive prices, larger screens, and improved features. Oppo has overtaken Samsung in Egyptian smartphone market.

IDC expects the African phone market to contract 8.4 percent in Q1 2020 to total 48.7 million units due to uncertainty caused by the global COVID-19 outbreak.

The closure of factories in China following the COVID-19 outbreak has severely disrupted the supply chain for components used in the production of smartphones.