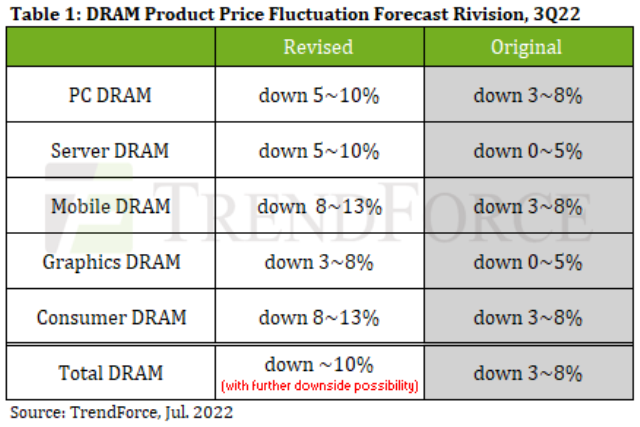

DRAM price is set to drop by nearly 10 percent quarter-on-quarter in Q3 2022 due to sluggish demand in PC and server businesses, according to the latest TrendForce research.

Facing uncertain peak-season demand in 2H22, some DRAM suppliers have begun effectively expressing clear intentions to cut prices, especially in the server field, where demand is relatively stable, in order to reduce inventory pressure.

Facing uncertain peak-season demand in 2H22, some DRAM suppliers have begun effectively expressing clear intentions to cut prices, especially in the server field, where demand is relatively stable, in order to reduce inventory pressure.

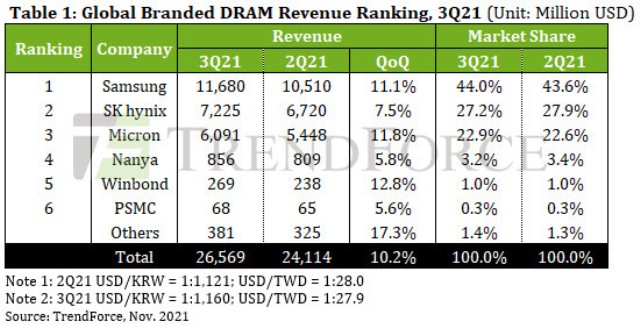

Samsung, SK Hynix, Micron, Nanya, Winbond and PSMC are the leading suppliers of DRAM, according to Q3 2021 statistics from TrendForce.

PC OEMs have downgraded their shipment prospects. With average DRAM inventory levels at more than two months, unless a huge price incentive exists, there is no demand for procurement. Thanks to adoption of the advanced 1Z/1alpha process, supply increased in 3Q22. DDR4 output could not be reduced due to high pricing limiting the penetration rate of DDR5. The price decline of PC DRAM in 3Q22 is revised to 5~10 percent.

Server DRAM inventory clients have on hand is approximately 7 to 8 weeks. Buyers’ consensus is that the price of DRAM will fall due to increased inventory pressure on sellers. If manufacturers are willing to provide attractive quotations, server OEMs are willing to discuss the possibility of volume commitments, the report said.

Server DRAM inventory clients have on hand is approximately 7 to 8 weeks. Buyers’ consensus is that the price of DRAM will fall due to increased inventory pressure on sellers. If manufacturers are willing to provide attractive quotations, server OEMs are willing to discuss the possibility of volume commitments, the report said.

As advanced manufacturing processes progress dynamically and terminal consumer products continue to weaken, server DRAM has become the only effective sales outlet. Korean manufacturers were the first to signal a willingness to discuss a pricing reduction of more than 5 percent, which expanded the decline of server DRAM to 5~10 percent in 3Q22.

Smartphone OEMs have already downgraded their smartphone production targets due to the sluggish economy. Smartphone brands are pessimistic regarding future prospects, casting a gloom over their attitude towards materials stocking. The output of mobile DRAM increased in 3Q22 due to the adoption of advanced processes among several manufacturers, increasing pressure on suppliers. Given the polarized disparity between supply and demand, the pricing decline of mobile DRAM is forecast to expand to 8-13 percent this quarter.

Demand for graphics DRAM procurement has weakened due to inflation-related reduction in consumer products demand and a faltering cryptocurrency market. Migrating graphics DRAM production capacity to other types of DRAM products in not as easy as migrating standard DRAM (Commodity DRAM) capacity. Graphics DRAM pricing in 3Q22 is revised to decline 3-8 percent QoQ.

TV shipments lead the fall and demand related to networking and industrial applications have shown signs of weakening. The price of DDR3 is currently at a relatively high point and there is plenty of room for pricing to fall in the future. The decline in consumer DRAM pricing is forecast to deepen to 8~13 percent this quarter.