Sale of semiconductor manufacturing equipment is forecast to grow 14.7 percent to a record $117.5 billion in 2022 and $120.8 billion in 2023, SEMI announced today.

![]()

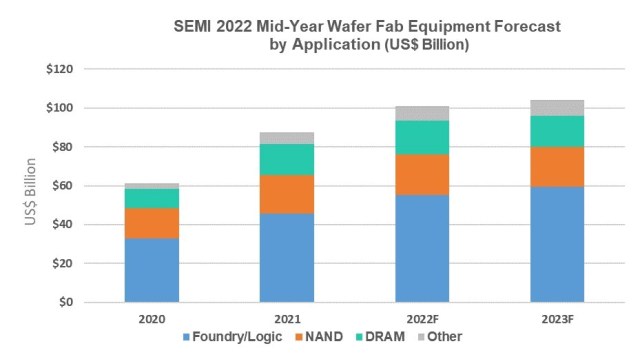

Both the front-end and back-end semiconductor equipment segments are contributing to the market expansion. The wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, is projected to increase 15.4 percent to $101 billion in 2022, followed by a 3.2 percent increase to $104.3 billion in 2023.

“In line with the semiconductor industry’s determined push to increase and upgrade capacity, the wafer fab equipment segment is poised to reach the $100 billion milestone for the first time in 2022,” said Ajit Manocha, president and CEO of SEMI.

Driven by demand for both leading-edge and mature process nodes, the foundry and logic segments are expected to increase 20.6 percent to $55.2 billion in 2022 and 7.9 percent, to $59.5 billion, in 2023. The two segments account for more than half of total wafer fab equipment sales. Demand for memory and storage continues to contribute to DRAM and NAND equipment spending this year. The DRAM equipment segment is leading the expansion in 2022 with expected growth of 8 percent to $17.1 billion. The NAND equipment market is projected to grow 6.8 percent to $21.1 billion this year. DRAM and NAND equipment expenditures are expected to slip 7.7 percent and 2.4 percent, respectively, in 2023.

Demand for memory and storage continues to contribute to DRAM and NAND equipment spending this year. The DRAM equipment segment is leading the expansion in 2022 with expected growth of 8 percent to $17.1 billion. The NAND equipment market is projected to grow 6.8 percent to $21.1 billion this year. DRAM and NAND equipment expenditures are expected to slip 7.7 percent and 2.4 percent, respectively, in 2023.

The assembly and packaging equipment segment is expected to grow 8.2 percent to $7.8 billion in 2022 and fell 0.5 percent to $7.7 billion in 2023. The semiconductor test equipment market is forecast to grow 12.1 percent to $8.8 billion in 2022 and 0.4 percent in 2023 on demand for high-performance computing (HPC) applications.

Taiwan, China, and Korea are projected to remain the top three equipment buyers in 2022. Taiwan is expected to regain the top position in 2022 and 2023, followed by China and Korea.