Telecom Lead Asia: With full year revenue of $35.75 billion in 2012 Ericsson continues to dominate the telecom equipment market against Huawei’s $35.43 billion income.

The difference in annual revenue between Ericsson (SEK 227.8 billion) and Huawei (220.2 billion yuan) is marginal.

Announcing the result on January 21, Huawei said the audited 2012 results will be published in Huawei’s annual report due in April. Ericsson announced its full year result on January 31.

Ericsson’s full year revenue from networks was SEK 117.3 billion; global services clocked SEK 97 billion and support solutions contributed SEK 13.5 billion.

READ Ericsson financial result for 2012 HERE

Huawei’s carrier network business achieved sales revenues of CNY 160.3 billion. Its consumer business recorded sales revenue of CNY 48.4 billion, while its enterprise business generated revenue of CNY 11.5 billion.

READ Huawei financial result for 2012 HERE

The key difference between Ericsson and Huawei is that Ericsson does not have both mobile phone / tablet and enterprise businesses. China’s largest telecom gear maker is aggressively focusing on these two businesses. Huawei, in 2012, became the top 5 mobile phone vendor, according to IDC.

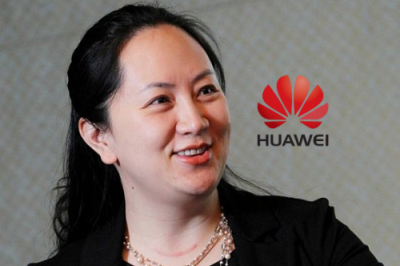

Cathy Meng, chief financial officer, Huawei

According to Cathy Meng, chief financial officer, Huawei, the company expects its overall revenue to grow 10-12 percent in 2013.

Hans Vestberg, president and CEO, Ericsson, said, announcing Q4 result: “With present visibility of customer demand, and with the current global economic development, underlying business mix is expected to gradually shift towards more capacity projects during the second half of 2013.”

IDC recently predicted that Huawei is poised to become the market leader in wireline and wireless equipment segment in 2013, overtaking Ericsson. Ericsson and Huawei continue to be the overall global telecom product revenue leaders from 2010 through the first half of 2012.

GEOGRAPHICAL DIFFERENCES

66 percent of Huawei’s revenue came from outside China. Among the overseas revenue, the Asia-Pacific region generated CNY 37.4 billion revenue, while Europe, Middle East and Africa recorded CNY 77.4 billion and the Americas contributed CNY 31.8 billion. The domestic market China recorded CNY 73.6 billion.

Hans Vestberg, president and CEO, Ericsson

For Ericsson, North America was the main marker, where Huawei is finding troubles due to security issues. Throughout 2012 North America was Ericsson’s strongest market, driven by mobile broadband investments and demand for services. Regions such as South East Asia and Oceania and Sub-Saharan Africa gradually improved in 202.

Market research group Gartner forecasts sales of network equipment to carriers to rise 2.3 percent to $79 billion in 2013, after falling 6.6 percent to $77.3 billion last year. North America and Latin America will grow by 4 percent, while Asia excluding Japan will be up 3.6 percent.

Year 2013 will be decisive for Ericsson and Huawei. Ericsson is building its broadcast and OS businesses. Huawei will focus more on enterprises and handset income to gain leadership.

Note: For calculation purposes, we have used US$ rate on the date of the announcement of the financial result for both companies. We also directly converted their respective reporting currencies to US$.

Arvind Krishna

[email protected]