Telecom network operator Axiata has selected Nepal for its future investment by acquiring an 80 percent stake in Ncell for $1.365 billion.

Axiata’s investment in Ncell marks the exit of global telecom operator TeliaSonera that announced plans to exit from seven telecom markets including Nepal.

Why Nepal?

Economy in Nepal has grown by a compound annual growth rate (CAGR) of 4.2 percent over the past six years. The country has a young population where an estimated 68 percent of its total 28 million is below the age of 35.

Its mobile broadband penetration is 21.5 percent, with 33.1 percent CAGR in internet subscribers from 2012 to 2014.

Nepal’s mobile penetration is 51 percent. Mobile subscriber growth in Nepal was an average of 18 percent from 2012-2014.

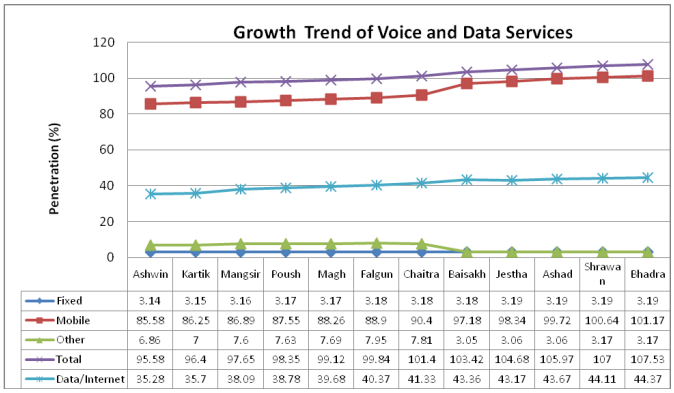

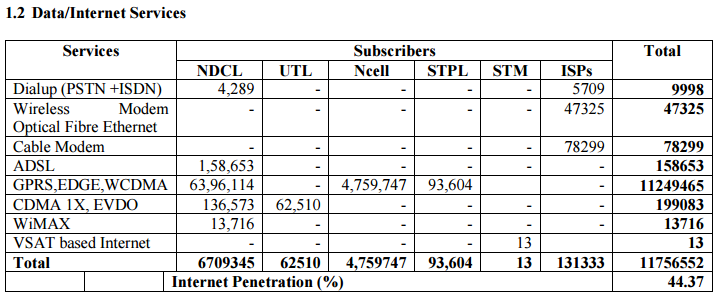

Nepal had 101.17 million mobile users and 3.19 million wired subscribers as of July 2015, according to NTA (Nepal Telecommunications Authority) website. Nepal had Internet penetration of 44.37 percent.

Why Ncell?

Ncell is the number one mobile operator with 12.8 million subscribers and second largest Internet operator in Nepal. Ncell has 57.5 percent revenue market share. Ncell has clocked $500 million or NPR 57.728 billion annual revenue.

As of July 2015, Ncell has 48 percent share in the Nepal mobile market against Nepal Doorsanchar Company’s 46 percent and STM Telecom Sanchar’s 5 percent.

The Internet share of Ncell was 40.49 percent against Nepal Doorsanchar Company’s 57.07 percent.

The investment will enable Axiata to have contiguous presence and reach in five key countries across South Asia. Axiata’s footprint in South East Asia and South Asia will cover 1.77 billion population and solidify the Group as one of the leading mobile network operators in the region with more than 280 million customers from 268 million today.

Axiata strategy

Axiata aims to expand presence in emerging Asia. It looks at brownfield investment, management control, growth market, attractive valuation, earnings accretive and within target footprint.

Ncell delivered revenue CAGR of 19.9 percent between financial year 2013 to 2015, with earnings before interest, tax, depreciation and amortization (EBITDA) margin of 62.2 percent in FY 2015. Its return on invested capital (ROIC) was over 70 percent in FY 2015.

Ncell has paired spectrum of 8MHz of 900MHz, 11MHz of 1800MHz and 10MHZ of 2100MHz spectrum.

The valuation of Ncell implied enterprise valuation over EBITDA of 5.0×5 including controlling premium compared to 5.7x and 8.4x for South Asia and ASEAN peers, respectively.

Axiata Group Chief Executive Officer Dato’ Sri Jamaludin Ibrahim said: “As with all our investments, we see our entry into Nepal as a long-term strategic move for the Group. Axiata is also committed to playing a major part in the development of the country by offering high-speed data connectivity.”

Baburajan K

[email protected]