Japan is aiming to force local wireless carriers to cut their monthly fees and stop bundling the cost of smartphones with wireless services, in a move that is likely to hit iPhone maker Apple.

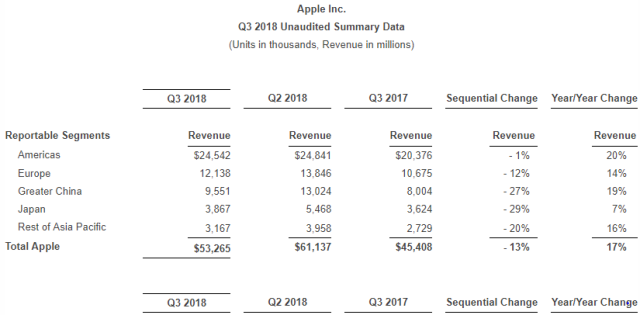

Apple has generated $3.867 billion revenue from Japan in Q3 fiscal 2018 as compared with $5.468 billion in Q2 fiscal 2018. Japan is the fourth largest smartphone market for Apple, a company based in the US.

Japan’s top wireless carriers, NTT Docomo, KDDI and SoftBank Group provide smartphones without upfront charges as part of fixed-term contracts that can cost as much as 10,000 yen or $90.51 per month. Smartphone customers on their telecom networks such as NTT Docomo, KDDI and SoftBank effectively pay for handsets in monthly installments.

Japan’s top wireless carriers, NTT Docomo, KDDI and SoftBank Group provide smartphones without upfront charges as part of fixed-term contracts that can cost as much as 10,000 yen or $90.51 per month. Smartphone customers on their telecom networks such as NTT Docomo, KDDI and SoftBank effectively pay for handsets in monthly installments.

The Japan government, which sees these contracts as muddying the cost of handsets and mobile fees and creating barriers for entry, wants carriers to charge separately for phones, Reuters reported on Tuesday.

An end to bundling could hit dominant player Apple’s iPhone sales as consumers opt for cheaper devices. Apple is the dominant smartphone vendor in Japan with 68 percent share, while the balance share is held by Sony, Huawei, Samsung, among others.

Apple iPhones account for one in every two smartphones sold in Japan, according to MM Research Institute, SoftBank CEO Masayoshi Son in 2008 introduced Apple iPhone in the Japan telecom market.

Apple may have breached antitrust rules by forcing Japanese carriers to offer discounts on iPhones and charge higher monthly fees, the country’s regulators said last month, giving the US firm an advantage over rivals such as Samsung Electronics.

Japan’s Chief Cabinet Secretary Yoshihide Suga said wireless operators have room to slash wireless fees by 40 percent, Kyodo News reported.

Japan hopes that it can stimulate spending in other areas by reducing the burden of wireless fees on households.

Telecoms fees as a percentage of household spending have continued to rise, government figures show, reaching 4.2 percent last year, driven by higher wireless costs.

A KDDI spokeswoman said the carrier has created plans that separate the cost of the handset and carrier fees, and has lowered fees for customers.

A Docomo spokesman says the firm has cut costs for customers and continues to consider changes to fees based on the wishes of customers.

A SoftBank spokeswoman said the carrier continues to examine how to improve services for customers.