Fitch Ratings has revealed its forecast for telecom operators in Malaysia.

5G spectrum payments and the proliferation of unlimited data plans may hamper an EBITDA recovery.

Malaysia has revoked its 5G spectrum allocation, which had been awarded to five companies, following a public backlash against the lack of a transparent, open-tender process. Meanwhile, TM’s narrowing returns and Capex resumption are likely to see leverage revert to above the industry average.

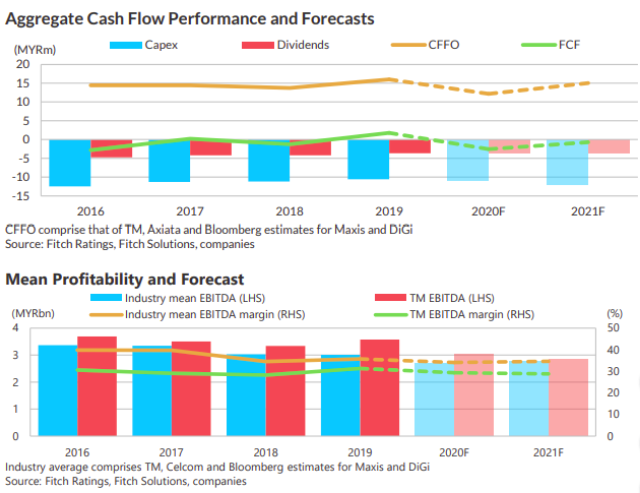

Fitch said its neutral 2021 forecast for the sector’s FCF reflects our expectation for cash preservation ahead of the 5G Capex upcycle to maintain balance-sheet strength.

Major telcos have cut dividends in the past to manage their leverage profiles. Operational cash flow may improve through cost-cutting measures, which should help offset higher capex.

Fitch said its capex projections exclude potential 5G spectrum fees, so any significant debt-funded capex would delay deleveraging.

Competitive pressure is a key headwind for the sector, potentially capping an EBITDA recovery. However, telcos are unlikely to engage in long-term price competition, as they turn to convergence strategies to reduce customer churn and meet the rising demand for online connectivity during the pandemic.

Maxis , Celcom Axiata and DiGi.Com are also scaling up their converged offerings through wholesale arrangements with TM and TIME dotCom.

TM will retain its dominant position in Malaysia’s fixed-broadband market. Its ability to deploy converged services through quadruple-play offerings should enable it to compete more effectively against domestic fixed-line providers and mobile operators.

TM will continue to rely on domestic roaming to support its wireless coverage in the absence of a clear spectrum roadmap.

The lack of clarity on the country’s 5G policy framework and spectrum timeline could delay network commercialisation until 2022. The government’s original consortium model could help to defray costs amid tough market conditions.

Meanwhile, a single national wholesale 5G network will strengthen TM’s competitiveness and converged network strategy, but this would hinge on TM’s ability to obtain sufficient spectrum. The extensive fibre infrastructure needs to support higher data speeds and capacity puts TM in a strong position.