Telecom industry bodies such as GSA, GSMA and COAI have explained the need for India to conduct mmWave spectrum auction for bolstering 5G network.

India is yet to announce final reserve price for 5G spectrum. Telecom operators such as Airtel, Vodafone Idea and Reliance Jio are aiming to spend billion dollars on 5G network expansion across India.

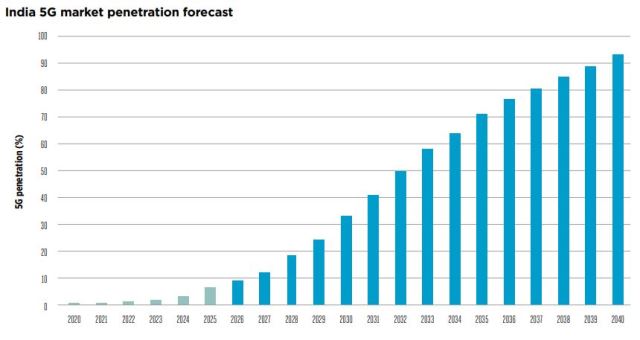

GSMA said mmWave spectrum is expected to deliver $150 billion in additional GDP for India over 2025–2040.

ALSO READ: Report on benefits of mmWave spectrum for 5G

5G technologies will make contribution of approximately $450 billion to the Indian economy (0.6 percent of GDP by 2040) over the period 2023–2040, GSMA said. The manufacturing sector is set to benefit the most from 5G applications (accounting for 20 percent of the total benefit), followed by retail (12 percent) and ICT (11 percent).

5G networks need a mix of spectrum across low (i.e. sub-1 GHz), mid (e.g. 3.5 GHz) and high (e.g. mmWave) bands. The ITU recommends 80–100 MHz of contiguous spectrum in the prime mid bands and around 1 GHz of contiguous spectrum per operator in the high bands.

mmWave spectrum in particular will play a crucial role in enabling the high-speed and ultra-low-latency features required by many 5G applications. India will benefit significantly from mmWave-enabled 5G.

Stakeholders in India need to focus on the following to maximise the socioeconomic benefits of mmWaveenabled 5G.

The Indian government should initiate the process of including the new mmWave bands in the National Frequency Allocation Plan (NFAP) and make the timeline for spectrum release available to industry stakeholders as soon as possible.

India should consider assigning mmWave spectrum bands to operators as soon as possible and in sufficiently large contiguous blocks. This will ensure they are able to deliver the low-latency, high-speed and high-capacity capabilities of 5G.

Licensed spectrum should be the core 5G spectrum management approach.

Spectrum set-asides need to be carefully considered, as they could jeopardise the success of public 5G services and may prove to be an inefficient use of spectrum. Sharing approaches such as leasing are better options where verticals require access to spectrum.

Indian regulators should avoid inflating mmWave spectrum prices as it risks limiting network investment and driving up the cost of services. This includes excessive reserve prices or annual fees, excessive obligations and poor auction design. In particular, cost associated with obligations, if any, should be deducted from the final price.

“Government should make the spectrum release timeline available to industry stakeholders as soon as possible,” said Manoj Misra, senior public policy director of GSMA India.

Availability of mmWave spectrum for 5G in India will also drive much needed investments in this sector, as this spectrum will be useful for driving the Digital India programme, said SP Kochhar, director general at COAI.

Jitendra Singh, head, GSA, said there are no technical co-existence issues of 5G with any of space services in India and sufficient protection margins are available for opening up both 26 and 28 GHz bands immediately for rolling out 5G in these mmWave bands.