Rakuten Mobile Network, the fourth telecom operator in Japan, has revealed its main tech partners for running the network.

Rakuten is trying to bring out innovation in its network architecture before the launch in Oct 2019.

Rakuten is trying to bring out innovation in its network architecture before the launch in Oct 2019.

First, Rakuten’s base stations in Japan have less kit than those in a conventional cellular network. Rakuten site includes a simplified radio antenna, a remote radio head and a fiber connection. There is no cabinet packed with elaborate electronics.

Second, Rakuten’s new network will have thousands of edge data centers — managed by small team thanks to its focus on automation – ensuring low cost of ownership.

Third, its mobile network will be powered by software running on standardized hardware, rather than the expensive proprietary hardware that runs traditional cellular networks.

Fourth, Rakuten’s cloud- native architecture will be fully virtualized from radio access to core, with end-to-end automation for both network operations and services.

Fifth, the technology partners of Rakuten Mobile Network including Cisco, Nokia, Intel, Altiostar, Red Hat, Mavenir, NEC, among others, are ensuring that their technology will improve customer experience.

“We can disrupt the telecoms industry and bring huge value to customers,” Rakuten founder Hiroshi Mikitani said during the Mobile World Congress on Wednesday.

Tareq Amin, the chief technology officer of Rakuten Mobile Network, is the main person behind its network build. Tareq Amin, who left Indian 4G telecom operator Reliance Jio, has received initial lessons about running a telecom network cost effectively from Jio team headed by Mukesh Ambani, the richest Indian.

Jio was the latest telecom operator to enter the crowded Indian telecom market with free voice and data offers in Sept 2016 disrupting the financials of established operators. Jio has nearly 300 million 4G customers. Jio made a profit in the initial phase of the launch though analysts are questioning the methods of showing profit.

Rakuten is yet to reveal its Capex plans for the network. Reliance Jio made huge investment in networks to bolsters its network.

Rakuten faces competition from KDDI, NTT Docomo and SoftBank to grab the first one million subscribers. Rakuten is aiming to grab 15 million subscribers. By comparison, No. 3 carrier SoftBank has about 39 million subscribers in Japan.

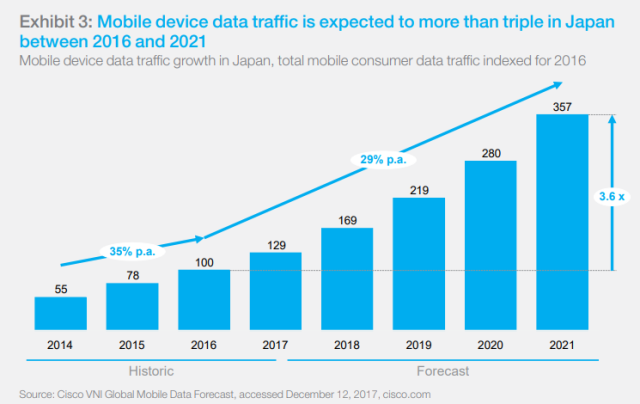

KDDI, NTT Docomo and SoftBank have a high monthly average revenue per user (ARPU) of $38, compared with $20 for operators in Europe. Japanese telecoms still manage to have a low monthly churn of 0.7 percent, compared with 1.9 percent in Europe, a McKinsey report said in January 2018.

It seems the initial focus of Rakuten will be on the building up of the cost effective network that can attract customers. Mobile phone customers are already complaining about poor data speed, McKinsey report pointed out.

Rakuten Mobile Network CTO Tareq Amin said: “We selected a vendor ecosystem to offer high-value services at more affordable costs, helping our customers to share the true benefits of cloud innovation.”

Main vendors

Nokia

Nokia will provide turnkey services to deploy and integrate cloud RAN, AirGile cloud-native core network technology and several Nokia software functions.

Nokia will be supplying its Intelligent Management Platform for All Connected Things (IMPACT) to help the company tap new revenue opportunities through the rollout of Internet of Things (IoT) services across Japan.

Rakuten can deploy various IoT applications faster and more cost effectively across multiple sectors such as agriculture, industry and the automotive field, including connected vehicles.

Intel

Rakuten selected Intel architecture to accelerate wireless network innovation and capability. A programmable, high-performance network platform supports its strategy to diversify and grow its business.

Cisco

Networking major Cisco supplied software and services, and routing and switching hardware. Cisco delivered its technology — virtualized network with a common and distributed telco-cloud with NFVI; multi-access edge computing; 5G-ready system architecture; 5G enabled IPv6 transport / mobile backhaul; SDN-enabled centralized and regional data center fabrics for 5G and end-to-end infrastructure and service automation.

Red Hat

Rakuten will use Red Hat’s open source technologies for launching its new mobile network in 2019. Red Hat Enterprise Linux; Red Hat OpenStack Platform; Red Hat Ceph Storage will be powering the network.

Altiostar Networks

Rakuten will use virtualized radio access network (vRAN) technology provided by Altiostar Networks, on Red Hat OpenStack Platform, enabling it to develop mobile services in a software virtualization environment.

Rakuten will use vRAN technology to power both of the RAN services on general purpose servers that interface to zero footprint radio cellsites. This helps Rakuten Mobile Network to prepare for the 5G future of mobile networks while still rolling out 4G services.

NEC / Netcracker Technology

Rakuten will use Netcracker’s digital BSS solution to ensure better digital experiences across its communications channels.

Mavenir

Mavenir’s virtualized RCS AS and Client will enable Rakuten to launch new services quickly for enterprises and subscribers. Rakuten will use Mavenir’s platform that monetizes voice and messaging in a single application for roaming. Rakuten ID single sign-on is cloud-based with full NFV deployed on the Rakuten Cloud Platform.

Incidentally, some of the technology partners of Rakuten in Japan are already working with Reliance Jio in India. Rakuten says it has a global target. Will it enter India? Will telecoms follow Rakuten business model?

Baburajan K