Telecom operators are giving more thrust on the OTT video market which will achieve 10 percent CAGR to $51.4 billion in revenue in 2022.

ABI Research forecasts that OTT video services will put more pressure on traditional Pay-TV services especially in the developed markets with high broadband and Pay-TV penetration. The revenue growth will be supported by OTT video subscriber base that will be reaching 400 million in 2018.

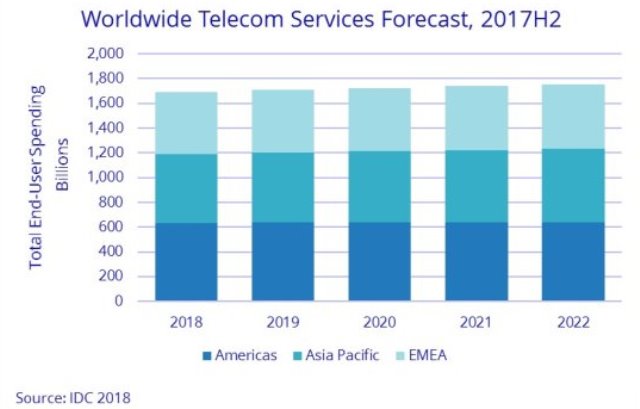

IDC, a leading global research agency, said spending on telecommunications services and pay TV services will be growing at a CAGR of 1.1 percent during the five-year forecast period (2018-2022 from $1,662 billion in 2017. IDC did not reveal the pay-TV revenue or its growth pattern.

ABI Research said OTT video services offer less expensive alternatives and no long-term contract features compared to existing Pay-TV offerings that are driving an increasing number of Pay-TV customers to switch to these OTT services.

Frost & Sullivan last month said India, a developing telecom market, has 180.3 million active online video viewers and almost 4 million registered subscribers. OTT video services market earned over INR 37 billion in 2017, and will likely grow at a CAGR of 17.3 percent over the next five years.

The Indian OTT video market is waking up to the subscription video on demand proposition, and it will have more takers in the next five years, said Aafia Bathool, research analyst, Digital Media Practice, Frost & Sullivan.

Among freemium model platforms, Indian service providers are seeing conversion of only about 2 percent of viewers from advertisement based video on demand (AVOD) to SVOD, establishing a dominance of AVOD based business models in the long term, says Vidya S. Nath, senior research director, Digital Media Practice, Frost & Sullivan.

ABI Research said Pay-TV operators in telecom markets such as North America and Europe have started OTT services to improve churn by providing less costly video service. AT&T-owned DirecTV’s Now, Dish Network’s Sling TV, and Sky’s Now TV are offering Virtual Multichannel Video Programming Distributor (vMVPD) services, linear channels via internet connection.

“vMVPD services offer live TV packages as low as $10 and customized packages are attracting cost- sensitive customers,” said Khin Sandi Lynn, industry analyst at ABI Research.

Dish Network’s Sling has secured more than 2 million subscribers in the two years since it launched.

DirecTV Now has gained 1.2 million subscribers within one year of its launch, offsetting the subscriber loss of its satellite TV platform.

ABI Research said Pay-TV operators recognize the consumer demand for vMVPD services and are trying to expand their OTT offering by providing more content choice to compete against other subscription OTT services such as Netflix.

Despite the low cost of basic vMVPD packages, the availability of live sports packages and customization features contribute the higher ARPU compared to other subscription OTT services.

Hulu and YouTube launched live streaming packages in 2017 creating more competition in the vMVPD market. Availability of high-quality broadband network will bolster OTT video and Pay-TV user base across the globe.

“Fixed data services will grow by 4 percent due to demand for broadband, Ethernet, and high-speed fiber connectivity. While mobile voice revenues are declining, this sector will be sustained by strong growth in data and other services,” said Courtney Munroe, group vice president, Worldwide Telecommunications Research at IDC.

ABI Research says the growth of subscription OTT services has been driving the changing trends in the Pay-TV landscape. OTT video services have attracted hundreds of millions of subscribers worldwide, causing pressure on traditional Pay-TV operators.

Baburajan K